Russia is very likely to seize further Western business assets still in the country, including of firms from France, Germany, the UK and Poland

This assessment was issued to clients of Dragonfly’s Security Intelligence & Analysis Service (SIAS) on 26 June 2024.

- That would be in retaliation for a plan approved by G7 leaders in June to raise a loan of around $50 billion for Ukraine by year’s end, backed by interest on seized Russian assets

- We assess this will enable Ukraine to maintain its defensive capacity and economic stability well into 2025, even if the US halts aid

We assess that a sizeable new loan agreed in principle by the G7 in June will very probably aid Ukraine’s defensive capacity and economic stability well into 2025. In our analysis, the deal was aimed to ensure large-scale funding to Ukraine should a win for Donald Trump in the US presidential election in November lead to a halt in US aid. And given the sum involved, it will probably also give Europe more time to develop additional funding mechanisms to help to fund Ukraine’s defence into 2026.

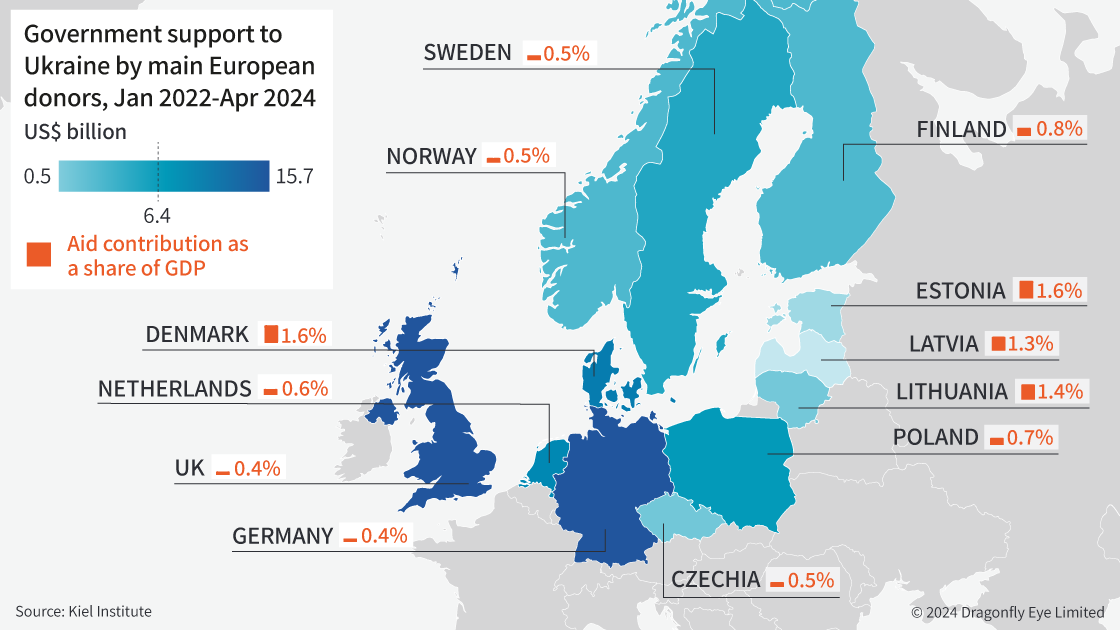

Russia will probably respond by seizing more assets of Western firms still operating there. Those most exposed are firms headquartered in the European countries that Russia perceives as most supportive of Ukraine’s defensive efforts. These include Czechia, Denmark, Estonia, Finland, Germany, Latvia, Lithuania, the Netherlands, Poland, the UK and the US.

New loan to bolster Ukraine’s defence into 2025

The creation of a fresh aid vehicle by the G7 countries is very likely to enable Ukraine to sustain its defence into 2025. On 13 June, the leaders of the G7 approved in principle a plan to raise a new $50 billion loan for Ukraine by year’s end. This will facilitate large-scale weapons procurement, while helping to cover the costs of mobilisation and military training. This sum is equal to more than half of Ukraine’s planned budget spending for 2024, so is also very likely to mitigate the risk of a major economic crisis in Ukraine undermining the war effort in the coming year.

Prospect of second Trump presidency behind loan’s timing

The timing of the loan suggests it is aimed at pre-empting any halt in US aid to Ukraine should Donald Trump win the US election in November. The means for securing the loan – using the interest on Russian assets in Western financial institutions – are a marked break with Western conventions on private property. This is one of the reasons that European leaders in particular have been reluctant until now to use these Russian assets for the benefit of Ukraine.

But with the election approaching, Trump has continued to express scepticism over the US continuing to aid Ukraine, most recently on the campaign trail in Detroit on 15 June. Moreover, for Europe, the prospect of a second Trump victory not only spells the likelihood of having to bear a much greater share of military aid to Ukraine in particular, but also of a US pull-back, or even pull-out, from NATO.

G7 loan gives Europe time to develop offsetting aid mechanism

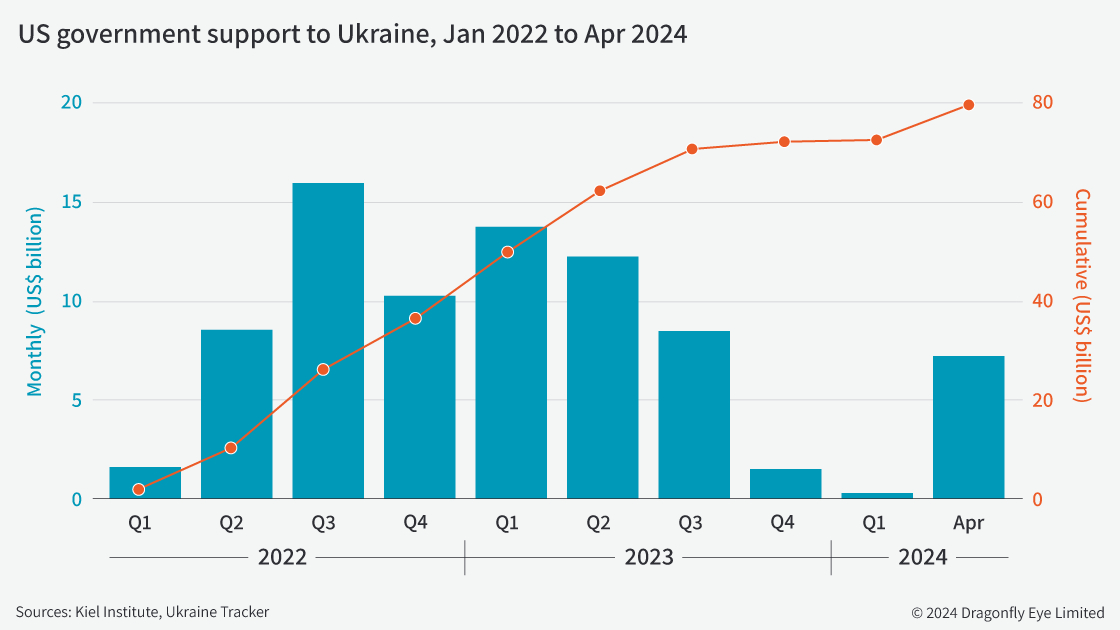

The new G7 loan will also allow Europe more time to develop additional longer-term funding mechanisms. On this, several clients have asked us about the capacity of Europe to ‘fill the funding gap’ should the US pull out. Since the Russian invasion in 2022, the US has, on average, provided about $34 billion in funding a year, according to the Kiel Institute, a German think tank. By the end of April 2024, it had delivered a total of close to $80 billion to Ukraine (see the chart below).

In our view, concerns over European security linked to the outcome of the Russian-Ukraine war would strongly encourage the creation of a ‘replacement’ funding mechanism at European level, should the US halt funding. This is despite the political and institutional obstacles in the way. For example, from late 2023 Hungary delayed for some months the EU’s €50 billion aid plan. More recently, in an election in early June, far-right parties modestly improved their representation in the European Parliament, possibly increasing support for Hungary’s foreign policy position.

Alongside the G7 loan, continuing aid from Ukraine’s ‘core’ European supporters would help in this respect. These are among a group of countries most solidly behind Ukraine’s self-defence. This is shown by the size of the aid they have given to Ukraine as a share of their economies (see chart). In recent months, several European countries have announced substantial, multi-year funding commitments to Ukraine. They include the Netherlands, the UK, Germany and Sweden.

Russia is likely to respond by seizing more assets

Russia is likely to respond to the G7’s promised new loan by seizing Western financial and business assets still in Russia. Putin called the G7 loan plan ‘theft’ and warned that it would not go unpunished. Since the invasion in 2022, Russia has already expropriated the local business assets of Western firms. Most recently, in May 2024 it seized the local financial assets of several Western banks.

We assess the Western businesses most at risk are those from countries that Russia perceives as leading support for Ukraine, including by giving permission for it to use the weapons they supply inside Russia. These countries include Czechia, Denmark, Estonia, Finland, Germany, Latvia, Lithuania, the Netherlands, Poland, the UK and the US. In addition, the sectors most exposed appear to be those in which the Russian authorities judge they have sufficient domestic capacity to limit the practical economic effects – so far, this seems to include energy, food, drinks, and banking.

Image: British Prime Minister Rishi Sunak attends a meeting with Ukraine President, Volodymyr Zelenskyy, during day one of the 50th G7 summit in Fasano, Italy, on 13 June 2024. Photo by Christopher Furlong/Getty Images.